Market crashes... is this the real deal?

- B. Chase Chandler

- Aug 5, 2019

- 2 min read

Updated: Aug 6, 2019

The market seemed to fall apart Monday with the Dow down more than 900 points (more than 3%) at the low.

This is what we are positioned for. Our portfolios did very well today. While the S&P 500 ended the day down 3%, our more aggressive allocation was down about 1% and our more conservative allocation down less than 0.50%.

We cannot predict if the selling will continue or how bad it could get. The trade situation isn't getting better and the jury is very much still out as to if a Trump tweet can relieve the pressure this time.

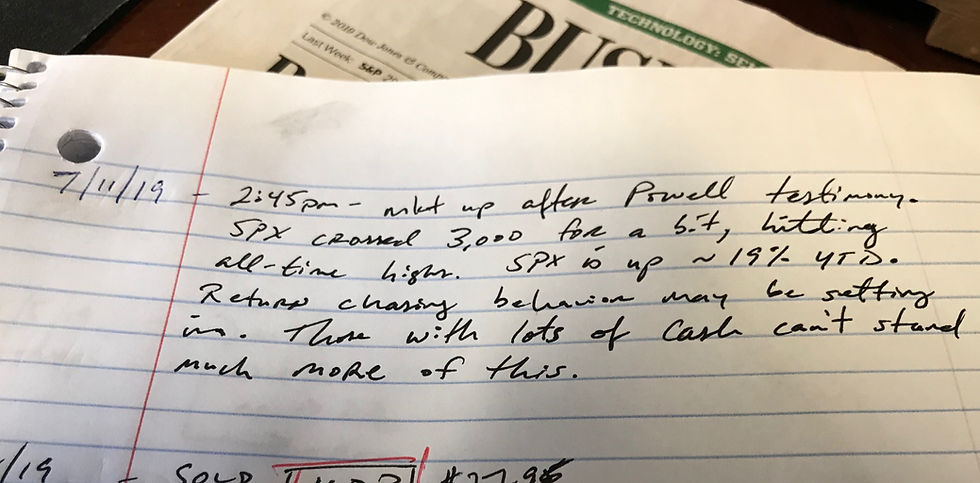

I made the following note (below) on July 11th with the purpose of reminding myself not to engage in return-chasing behavior. That is, the natural inclination to try to "catch-up" with market indices or other investors (like neighbors or your brother-in-law) after a period of lagging behind.

We began raising cash around this time (early July) or a little before. The last thing we want to do is get more aggressive when the market is up nearly 20% in just over half a year. Nay, we want to be more cautious. This may look foolish in the very short-term because it's almost impossible to time it exactly right. Yet the principle we're abiding by here is, we believe, timeless: to be more conservative when other's become less so, and vice versa.

We hold cash and hedge because extreme losses (~1/3 or worse) are indisputably more damaging to long-term returns than dragging behind the market by a myopically large, but logarithmically inconsequential amount. In layman's terms, we're more than fine with being up 10-12% in seven months when the market is up 17-20%. The desire to constantly beat (or stay with) the broad market inevitably leads to return chasing behavior, which inevitably leads to extreme losses.

We hope this is useful on this day of extreme market moves. As always, do not hesitate to reach out with questions.

Best, Chase

Comments